The need to offer efficiencies to the NHS creates an opportunity for pharma companies. But to be able to understand where those opportunities lie, they need to identify key networks – and the decision makers within each PCN. Here’s how Inspiremed can help.

The launch of NHS Primary Care Networks in spring 2020 could have a significant effect on pharma companies. The new networks are forming to improve the ability of practices to:

- recruit and retain staff

- manage financial and estates pressures

- provide a wider range of services to patients

- more easily integrate with the wider health and care system

The need to offer efficiencies to the NHS creates an opportunity for pharma companies. But to be able to understand where those opportunities lie, they need to identify the key drivers within each Primary Care Network – and build effective market access plans around these key PCNs.

As Primary Care Networks need to offer an improved local service, so pharma companies need to be able to identify the priority areas for each Primary Care Network, for example a specialism in diabetes care or osteoporotic care.

Pharma companies need to consider how they address the new breed of specialist ‘decision-makers’ within PCNs, and how they can influence these key personnel, by offering ‘value’ for the whole group.

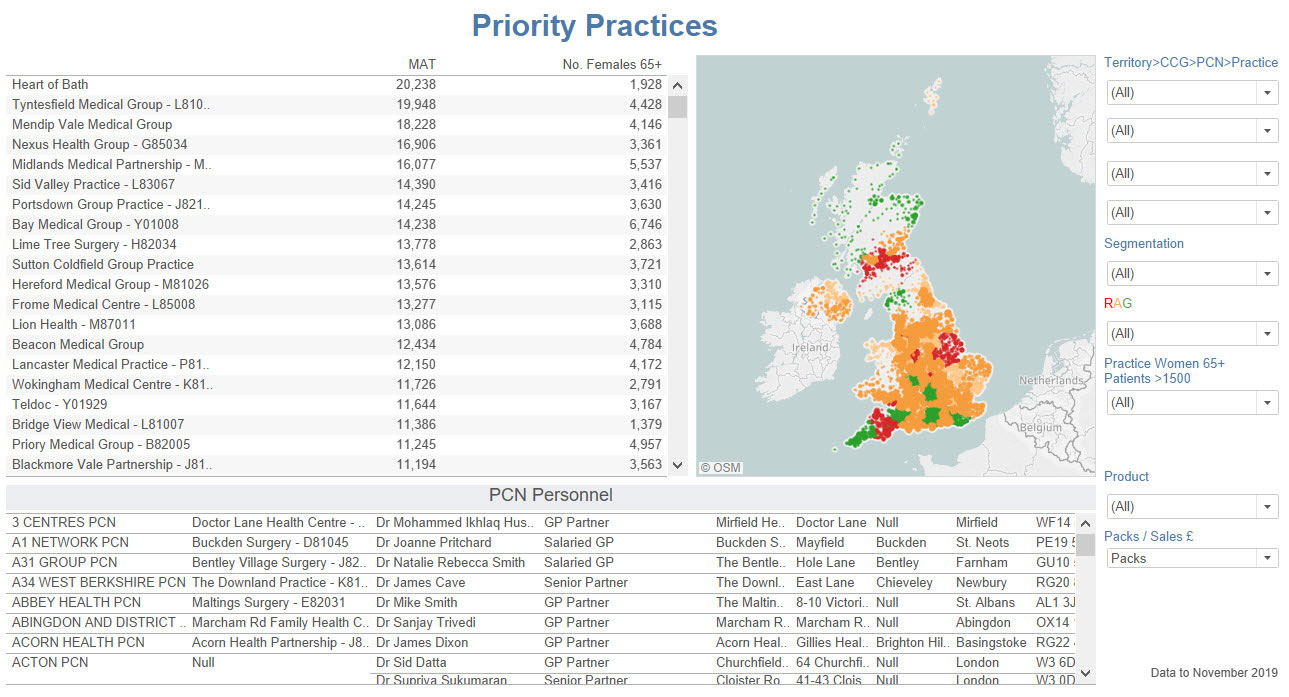

Inspiremed can help pharma companies to gain market access by mapping and segmenting PCNs into usable analytics that provide knowledge of and insight into the most potentially valuable groupings for their particular business.

Identifying each PCN’s priorities will be paramount to pharma’s success in developing good and effective market access strategy and campaigns.

How can Inspiremed help Pharma?

Mapping the key PCNs into market access analytics and segmentation models gives direct insight into how these groups are structured across CCGs – and will enable pharma to derive definitive strategies.

Our analytics can quickly help pharma with market access dynamics for this important and evolving NHS group.